From New Mexico and Wyoming to Delaware and Florida, we manage the full compliance lifecycle for foreign-owned businesses.

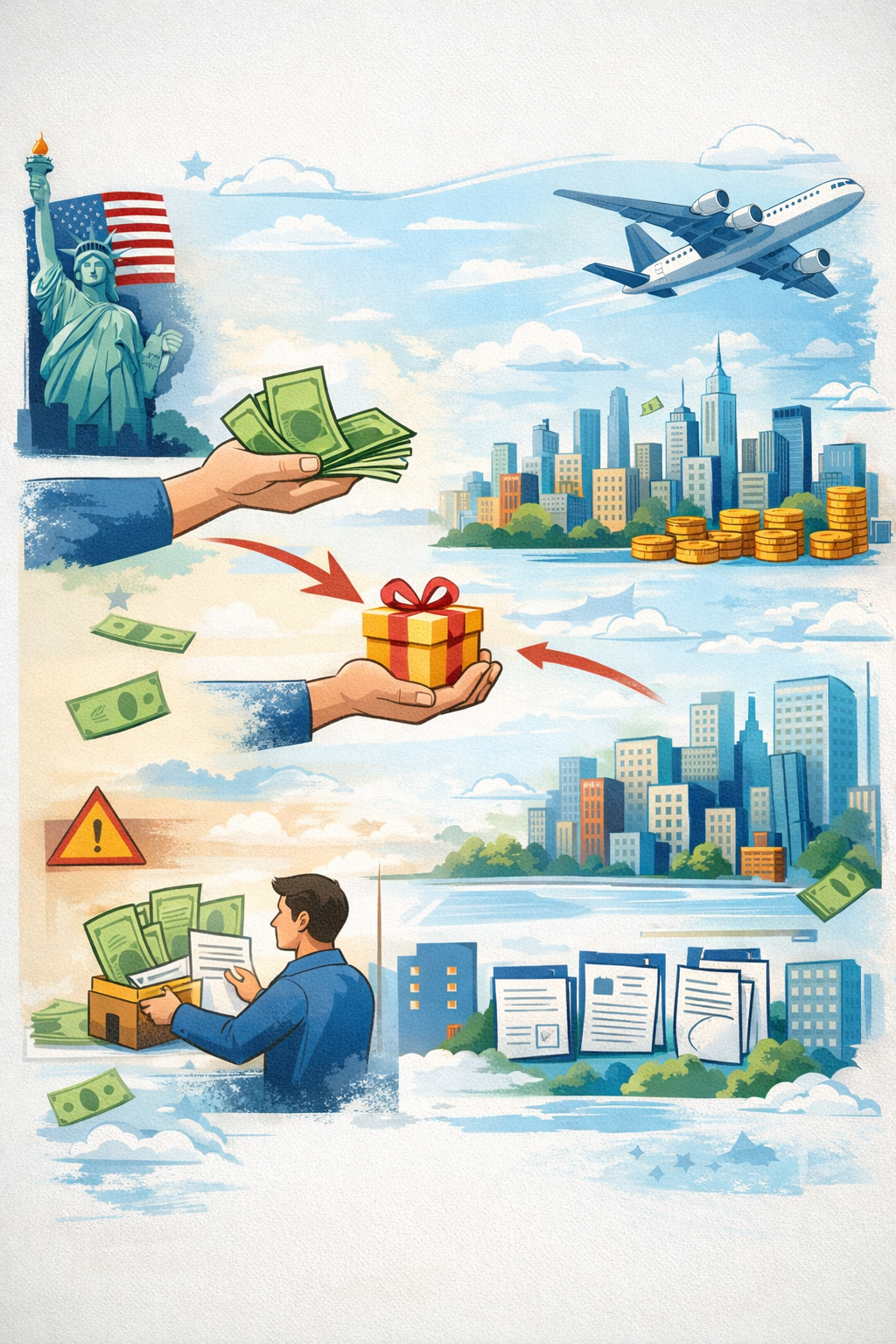

The move to the U.S. is a high-stakes tax event. We protect your global wealth during the transition.

U.S. real estate is a powerful asset, but it comes with a 40% "death tax" cliff for non-residents.

For the American abroad, the IRS is a lifelong partner. We make that partnership as inexpensive as possible.

As a Certifying Acceptance Agent, we help US resident and non-resident aliens, as well as other foreign taxpayers

Learn MoreThe secret behind the success of O & G services is the high sense of professionalism we exhibit

Learn MoreAs your trusted advisor, we evaluate your individual tax situation and guide you through any tax challenges that develop

Learn MoreO & G is your source for fast and reliable entity formation services that can simplify the process of getting your new business

Learn MoreHave you ever received a letter or notice from the IRS and ignored it…and now you owe penalties and fines on top of the taxes you already owed? You’re not alone.

Learn MoreAn organization’s back office management can significantly impact its success. We offer high quality professional services

Learn More

We offer a tax organizer that assists you in getting started on your taxes.

We specialize in providing professional accounting, book keeping, payroll/HR consultation and tax related services for both individuals and small businesses nationwide. We have the ability and efficiency to electronically offer our services in all 50 states.

By focusing on our clients virtually with our in-depth knowledge and expertise, we are able to provide a next level of service at a competitive rate than typical brick and mortar firms.

We don't just file forms. We build audit-ready defenses.

The cost of an error in international tax is a penalty you cannot afford. Trust the Attorney-CPA team that understands the law behind the numbers.

Ready for a bulletproof U.S. tax strategy?

Book Your Professional Consultation

If you’re a foreign founder building a U.S. startup (or converting an LLC into a C-Corp), you...

Read More >>